Outsourced Corporate Real Estate Director

Advisory services for Executive Committees on all real estate matters

Strategic support for Corporate Real Estate Directors (confidential assignments)

Asset Optimization, Development & Portfolio Management (real estate companies, family offices, and institutional investors)

Change Management in partnership with HR and Finance teams (workplace transformation, relocations, reorganizations)

Project Management Assistance (PMA) – Project leadership

ABOUT CARBYNE

Why the name C A R B Y N E ® ?

“Diamond is the hardest material in the world”

This statement, long considered absolute in gemology, has recently been challenged—just as the notion of “Safe Haven Value” in real estate has evolved.

Carbyne®, though still little known, has been proven to be 40 times harder than diamond (source: MSM), making it the most resistant material on Earth.

Real estate follows a similar truth: unless it is flawlessly managed across its technical, legal, and environmental dimensions, it cannot always be considered a true source of wealth—and may even show a negative valuation.

- When a full-time Real Estate Director isn’t the right fit

- The number or size of your properties may not justify hiring a full-time Corporate Real Estate Director—yet you still require a professional and accountable management of this highly specialized function, rather than leaving it to non-expert internal departments. (Many real estate issues can, in fact, expose company executives to personal legal liability.)

- Your existing Real Estate Director may also need occasional or ongoing support from a seasoned expert for sensitive or strategic matters that cannot be entrusted to in-house staff, due to the risk of internal information leaks.

- You seek comprehensive real estate oversight with the absolute guarantee of zero conflict of interest. With C A R B Y N E, your interests—and only your interests—are protected and represented.

GEORGE LAKHOVSKY

George Lakhovsky — Founder & Managing Partner

With over 35 years of experience in the real estate sector, George Lakhovsky has built a solid track record in management, development, and the restructuring of corporate real estate and investment property divisions.

His career spans a wide range of environments—from investors to occupiers—including investment funds, major corporations, semi-public companies, mid-sized enterprises, and family groups. This rare dual perspective provides him with a comprehensive, multi-disciplinary understanding of the diverse challenges faced by each of these stakeholders.

In addition to his academic background in real estate, law, finance, and asset management, he is also a National and European Expert in Real Estate and Movable Asset Management, a Member of the Royal Institution of Chartered Surveyors (RICS), the French Association of Corporate Real Estate Directors (ADI), and serves on the Steering Committee of the Agora des Directeurs Immobiliers. He is also a former Board Member of the Observatoire Régional de l’Immobilier d’Entreprise (ORIE).

George Lakhovsky is a graduate of INSEAD and lectures within the MBA program at Financia Business School.

He is supported by a network of highly regarded specialists for specific assignments.

PROFESSIONALISM – CONFIDENTIALITY – EXPERIENCE

EXPERTS

Real estate is a matter of vision and connection. Surround yourself with the right people — and you’ll see further.

JOHN JACOB ASTOR

Corporate Real Estate Strategy

&

Portfolio Optimization & Performance

- Audit, Optimization & Corporate Real Estate creation

- Recommendation of a Real Estate Strategy Aligned with Corporate Objectives

- Workplace Optimization & Space Rationalization

- Implementation & Optimization of Real Estate Processes

- Strategic Real Estate Roadmaps

Buy with intelligence, structure with discipline, and develop with vision.

BRUCE FLATT

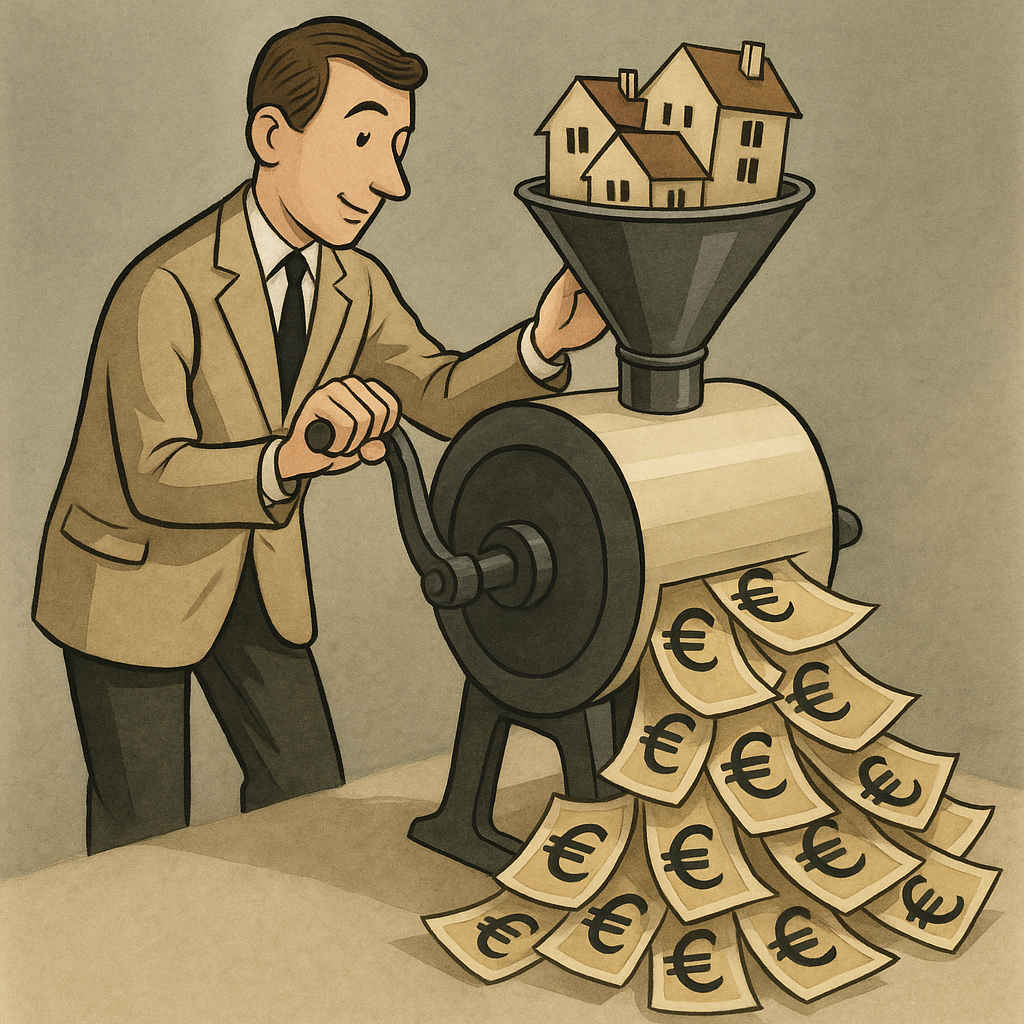

Property Development & Value Creation

&

Wealth Management

- Development Scenario Planning

- Definition and Structuring of Real Estate Projects

- Strategic Advisory and Transaction Management (from data-room preparation and due diligence to negotiation and signing)

- Management of Tender Processes (Coordination of Contractors, Architects, Project Management Offices (PMOs), and Technical Control Firms)

- Managing and advising on investment opportunities across Core, Core+, Value-Add, and Opportunistic profiles — ensuring disciplined underwriting, risk control, and long-term value creation.

- Owner’s Representation & Project Management Assistance

Well-managed real estate isn’t an expense — it’s a strategic asset.

WARREN BUFFET

Optimization of Existing Assets

&

Asset Efficiency

- Lease Negotiation and Renegotiation

- Implementation and Support of Real Estate Asset Management Processes

- Operating Cost Reduction and Space Utilization Optimization

Bringing a property into compliance means ensuring it stands the test of time — without losing its value

NORMAN FOSTER

Regulatory Compliance

&

Regulation - Compliance Frameworks

- Energy Performance (Thermal Renovation, HQE, BREEAM & LEED Certification).

- Alignment of Real Estate Assets with Environmental, CSR, and Regulatory Standards

- Adaptation of Real Estate Assets to ESG Requirements (Carbon Neutrality & Positive Social Impact)

- STRATEGY

-

Real estate is a matter of vision and connection. Surround yourself with the right people — and you’ll see further.

JOHN JACOB ASTOR

Corporate Real Estate Strategy

&Portfolio Optimization & Performance

- Audit, Optimization & Corporate Real Estate creation

- Recommendation of a Real Estate Strategy Aligned with Corporate Objectives

- Workplace Optimization & Space Rationalization

- Implementation & Optimization of Real Estate Processes

- Strategic Real Estate Roadmaps

- DEVELOPMENT

-

Buy with intelligence, structure with discipline, and develop with vision.

BRUCE FLATT

Property Development & Value Creation

&Wealth Management

- Development Scenario Planning

- Definition and Structuring of Real Estate Projects

- Strategic Advisory and Transaction Management (from data-room preparation and due diligence to negotiation and signing)

- Management of Tender Processes (Coordination of Contractors, Architects, Project Management Offices (PMOs), and Technical Control Firms)

- Managing and advising on investment opportunities across Core, Core+, Value-Add, and Opportunistic profiles — ensuring disciplined underwriting, risk control, and long-term value creation.

- Owner’s Representation & Project Management Assistance

- ASSET & PROPERTY MANAGEMENT

-

Well-managed real estate isn’t an expense — it’s a strategic asset.

WARREN BUFFET

Optimization of Existing Assets

&

Asset Efficiency- Lease Negotiation and Renegotiation

- Implementation and Support of Real Estate Asset Management Processes

- Operating Cost Reduction and Space Utilization Optimization

- COMPLIANCE

-

Bringing a property into compliance means ensuring it stands the test of time — without losing its value

NORMAN FOSTER

Regulatory Compliance

&

Regulation - Compliance Frameworks- Energy Performance (Thermal Renovation, HQE, BREEAM & LEED Certification).

- Alignment of Real Estate Assets with Environmental, CSR, and Regulatory Standards

- Adaptation of Real Estate Assets to ESG Requirements (Carbon Neutrality & Positive Social Impact)